My Projects

TRAI (Trading AI)

Developed a trading platform that evolved from a web scraper for stock-related content to a full-stack solution integrating sentiment analysis and market predictions. Currently implementing collaborative trading features to enable group-based investment strategies.

IMC Prosperity 3

Achieved top 0.14% globally (17th out of 12,000 teams) in IMC's algorithmic trading competition. Engineered a trading bot implementing market making, mean reversion, and statistical arbitrage strategies across multiple asset classes.

Can't be giving away our alpha that easily :).

Connect Four Bot

Built a game-playing AI using the minimax algorithm with alpha-beta pruning and Q-learning to achieve competitive Connect Four gameplay.

Stock Web Scraper

Fetches real‑time market data, pulls the latest Yahoo Finance headlines, scores each story’s sentiment, and lets an LLM rank the news by its likely impact on the stock. Currently training TextBlob library on financial news sentiment data for better results.

Physics-Based Soccer Simulation

Developed a comprehensive physics engine from scratch in C to power a realistic soccer simulation game. Implemented collision detection, force dynamics, player AI with team coordination, and realistic ball physics with accurate momentum transfer during player interactions.

Bitcoin Price Predictor

Used regression and XgBoost to predict future prices of bitcoin from closing prices. Working to build system to detect arbitrage opportunities in the crypto market and competing in DRW's cryptocurrency Kaggle compeition.

Memory Visualizer

Working on a program in HTML, CSS, and JavaScript to show C heap/stack memory allocation. Inspired by Caltech course CS 3 (Software Design).

Machine Learning Projects

Comprehensive portfolio of machine learning implementations spanning deep learning, supervised learning, and predictive analytics.

Competitive Coding

Competitive coding problems from USACO, CodeForces, CSES, and Advent of Code.

Personal Website

Built a responsive personal website using HTML, CSS, and JavaScript to showcase my projects, skills, and experience.

Python Statistical Tool

Working on a statistical tool package in Python. Inspired by two Caltech courses: ACM 11 (Introduction to Computational Science and Engineering) and ACM 157 (Statistical Inference).

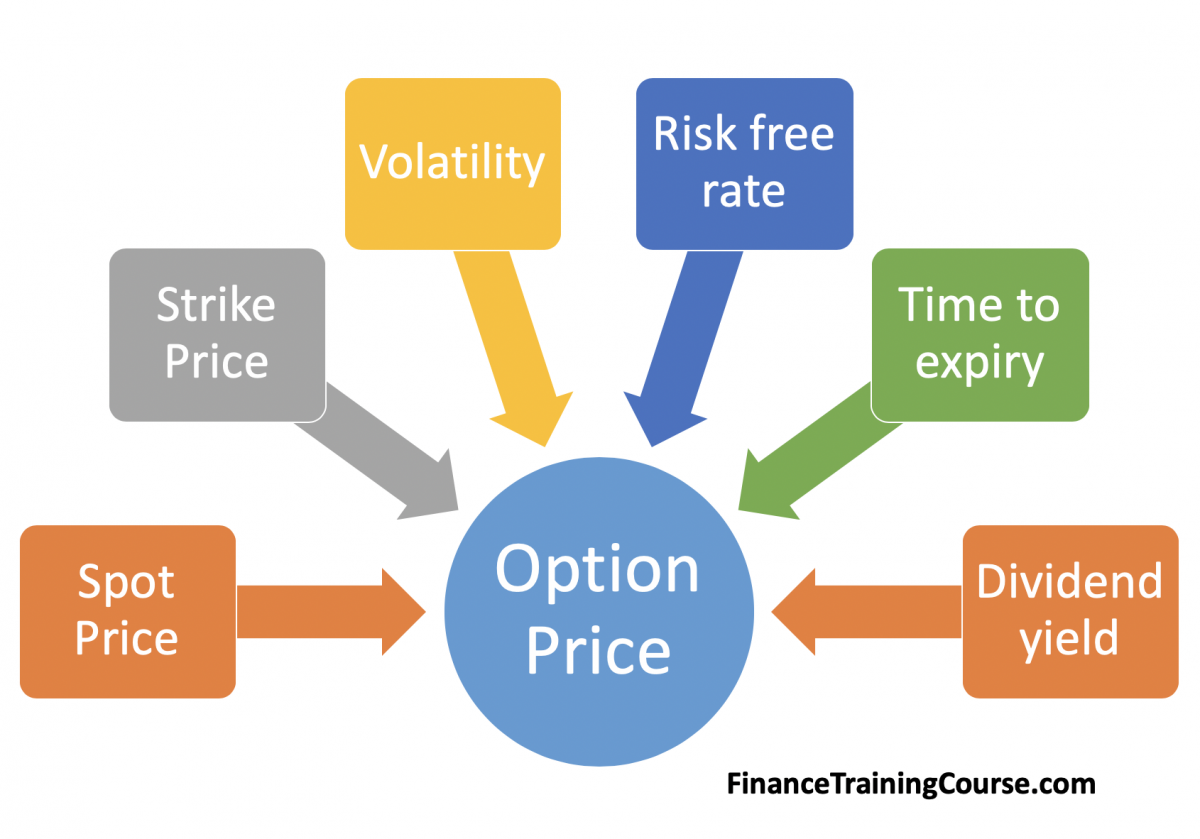

Options Pricer

Looking for arbitrage opportunities for options through Black-Scholes, Binomial, and Monte Carlo models.